Direct podcast download link: http://podcast.ioradio.org/IOR39.mp3?ior

By Adam Smith (adam@ioradio.org)

If there’s one thing crypto bros love to do, is talk endlessly about how awesome their tech and tokens are, about how messed up the real world is and how crypto magically fixes everything. But there are plenty of things they will not admit and don’t want to talk about. If you want to see how fast they’ll change the subject, bring up one of these topics:

- INFLATION IS NOT ALWAYS A BAD THING; ITS CAUSES HAVE MUCH LESS TO DO WITH “MONEY PRINTING” AND BITCOIN DOESN’T PROTECT YOU FROM IT ANYWAY

Crypto bros love to strawman “iNfLaTiOn” as an ominous financial cloud of doom that’s going to destroy your life. They’ll say, “The dollar has lost 70% of it’s value since 1900.” What they leave out is that the average family income in 1900 was $4000, and now it’s $70,000. Inflation doesn’t happen in a vacuum. Money in circulation increases to match increases in population and value creation, and wages and product prices adjust in comparison. Inflation is also what drives economic growth – Our fractional reserve system does indeed create monetary inflation, but it’s tightly regulated and controlled, not the “out of control money printer” crypto bros claim. And that ability to leverage and loan money is what helps millions of people each day: get a car they can’t buy outright, afford a home, go to college, and more. Probably the biggest contributor to the elevation of lower classes in society has been access to loans, which wouldn’t be possible without fractional reserve lending. In addition to that, sometimes inflation is necessary to address economic and social issues like a worldwide pandemic. Certain social programs increased the debt but they also kept people employed during the lockdown and likely avoided a long term depression as a result of Covid. This is how the system is designed to work. Now during better times, that debt and inflation is supposed to go down – if it doesn’t, it’s a problem with irresponsible people in government not paying their bills, and not the fact that our system is inflationary. Another major misconception people have is not understanding the dynamics between “inflation” and rising prices and assuming that primarily has to do with the amount of fiat in circulation. But perhaps the biggest misconception is the notion that “Bitcoin is a hedge against inflation” when in reality, the data does not show this is true. - THE CRYPTO INDUSTRY HAS ITS OWN INFLATION AND INFINITE MONEY PRINTER

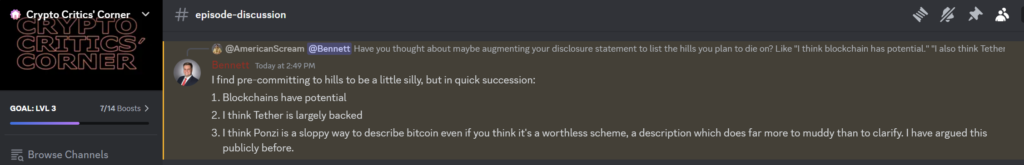

Stablecoins – The only reason they exist is to get around money laundering laws. If crypto was legit and its liquidity came from non-criminal sources, then the banking industry would be able to properly embrace it, but that’s not the case. Enter Tether, AKA USDT – the most prolific “stablecoin” in the industry, with more than $160 Billion worth of supposed value. The vast majority of all crypto trades are not between crypto and fiat, but crypto and USDT and other stablecoins. Since ideally USDT is supposed to represent 1:1 value mapping to the US Dollar, media pretends when 1 BTC sells for 60,000 USDT, that means “dollars.” Not really. The elephant in the room is that the so-called “reserves” of Tether, as well as many other stablecoins have never been independently audited according to basic accounting procedures accepted worldwide. There is absolutely no reason for Tether’s reserves to not be audited unless they are lying. Such an audit would reveal not only that they likely don’t have the reserves they claim, but that much of what they have probably comes from illegal sources, making the whole operation a liability — and exposing everything it touches to liability, which at this point, means the ENTIRE crypto market. - BLOCKCHAIN IS STILL A SOLUTION LOOKING FOR A PROBLEM

Sixteen years into this thing, there’s still not a single, non-criminal thing blockchain is uniquely good for. This technology continues to be a “solution” looking for a problem to solve. Occasionally you may find a municipality or company claiming they’re using “blockchain tech” but upon further investigation usually these claims don’t get past the PR/prototype stage, and if they do, they’re never the best solution to an application for which they’ve been applied. There’s a reason the technology behind blockchain: Merkle Trees, has not been widely used in the 60 years since its invention: it has very limited uses and is inferior to modern relational database technology and cryptography. - BITCOIN WASTES INSANE AMOUNTS OF ENERGY JUST TO EXIST

The computers that maintain Bitcoin’s database of who-owns-which-tokens are constantly engaged in a worldwide number-guessing-game that is the motivation for them to keep their databases online. Every 10 minutes one network guesses the right number (called a “nonce”) and gets a small reward of Bitcoin, and everybody else who was trying, gets nothing for their trouble. This is the mechanism by which third parties are motivated to maintain the blockchain. The problem is, this process produces nothing useful for anybody, and it wastes tremendous amounts of electricity, water, e-waste and other resources. The cost-benefit of “crypto mining” is perhaps an example of one of the most inefficient processes in the history of humanity. Crypto bros try to distract and whitewash this bizarre scheme by suggesting the energy consumption “drives advancements in renewables.” This is false. The primary objective of crypto is to make money, which means the cheapest power they can find, they will use, which is fossil fuels. The narratives about crypto using excess/un-needed energy is also false. If there’s too much energy one area is producing, there are many preferable solutions than using crypto to consume: redesign the energy grid, share the energy with someone who needs it, or use the energy for a more productive purpose, or even keep in the way it is (since mining produces nothing useful). Crypto is ultimately a “last resort” in terms of ways to use stranded energy. - NOBODY ENGAGES IN MORE GASLIGHTING THAN THE CRYPTO INDUSTRY

There’s a reason pro-crypto people find trying to promote their schemes don’t land well with average people: Crypto and blockchain technology really doesn’t make sense, and this isn’t because you’re not knowledgeable, it’s because it truly doesn’t make sense. Which is why crypto bros have to constantly gaslight people by saying, “You don’t understand” or “Have fun staying poor” or scare you with dramatic fearmongering over how “inflation” is going to turn the country into the next Zimbabwe. It’s all gaslighting. Trying to make people believe that what they perceive as reality (Bitcoin makes no sense as a store of value) is wrong. - CRYPTO IS A NEGATIVE SUM GAME – FOR EVERY PERSON TO WIN IN CRYPTO, MANY MORE HAVE TO LOSE

The world of crypto is filled with catchy slogans, from “HODL” (Hold On for Dear Life/hold and don’t sell) to WAGMI (We’re All Going To Make It). These slogans are part of the cult-like aspect, to distract you from the actual math involved in how Bitcoin’s return-on-investment model actually works. The idea, WAGMI, that everybody in crypto is going to come out ahead, is patently false. For every person in crypto who’s $1 “investment” returns $10, requires ten other peoples’ $1 “investments” to be lost. Those ten “greater fools” now depend on 100 additional greater fools to show up with $1 each for them to see the same returns. This R.O.I. model is totally unsustainable and will inevitably collapse. The “HODL” mantra helps maintain the illusion by encouraging people to not sell. If people keep holding, they don’t realize they’ve lost 100% of their principal yet. It’s a giant, decentralized game of musical chairs where, in the end, less than 1% will ever come out ahead. But it’s even worse than that, because as we know, all along the way there are other entities siphoning pieces of peoples’ money along the way: exchanges and middlemen are getting fees for transactions, and the miners consume massive amounts of resources, making crypto a resource-losing proposition. And for what? As mentioned before, the tech still can’t demonstrate it does anything better than what we already have. - THE HISTORY OF BITCOIN AND BLOCKCHAIN IS LITTERED WITH ALL FAILURES AND NO SUCCESSES

Ask a crypto bro about any crypto project more than several months old and they will quickly change the subject. There is no other industry that has such a tremendous array of never ending press releases that point to nothingburgers. This is why the mantra, “It’s still early” pervades conversation: Look forward. Don’t look back. We don’t want you to see our myriad of failed promises. Crypto’s first failure was its principal failure that nobody wants to talk about: Bitcoin being abandoned as a “currency.” The volatility and slow transaction performance made bitcoin wholly unsuitable for its core purpose, and L2s didn’t fix that. Hence the need to re-invent it as “digital gold” which has its own array of problems and failures. From there, the “blockchain revolution” moved onward, desperately trying to be relevant, and failing at every turn: Remember how NFTs were supposed to “revolutionize the art world?” Or how about how “Web3” was going to change the way we use the Internet? Crypto gaming and Axie Infinity — strings of exploited people in third-world countries because of crypto. ICP and a “censorship proof Internet?” DeFi and Staking? Now they’re distant memories in favor of the current buzzwords like “ETFs” and “Strategic Bitcoin Reserves.” Crypto ETFs are already proving to not live up to the hype and mostly represented a lateral move. And a few politicians talking about the government holding Bitcoin has made the crypto media froth at the mouth like it’s an inevitability. If there’s one limitless resource in the crypto industry, it appears to be irrational hype over the future — just don’t look at the past. When you do, you don’t see any success stories, only failures. This is why nobody’s talking any more about “El Salvador” and its adoption of Bitcoin which has become a dismal failure. Instead the industry has pivoted to Argentina – it’s new, there’s insufficient evidence that bitcoin won’t do anything useful there yet! - THE ENTIRE CRYPTO MARKET IS SATURATED WITH MANIPULATION AND CRIME AND IS IN NO WAY TRANSPARENT OR REGULATED DESPITE BEING COMPARED TO MARKETS THAT ARE WELL REGULATED

The crypto industry constantly borrows nomenclature from the traditional finance industry, despite their versions of these things being fundamentally different from what they represent in the traditional finance market. Terms like: bank/banking, exchanges, market cap, technical analysis, liquidity, assets, etc… when applied to crypto often don’t make much sense. Crypto promises people can “be their own bank” but crypto actually doesn’t offer the services traditional banks offer. Their version of “banking” is something completely different. Same with “market cap” – which is a meaningless metric when referring to crypto. But most importantly, crypto exchanges are not like traditional brokerage houses. They may appear to facilitate trades between parties, but they’re largely private, shady systems that have no oversight or accountability. There’s overwhelming evidence these operations are actively engaging in market manipulation and wash trading. They also do not offer any significant consumer protections. Many playing in the crypto market have been misled into thinking these exchanges have similar protections to their traditional exchanges and they are very wrong. As expected, crypto proponents will engage in a “Whataboutism” fallacy suggesting there’s crime and manipulation in traditional markets too, but that doesn’t excuse the fact that the extent to which the crypto market is composed of unregulated, criminal activity, percentage wise, is significantly higher. - NOT ALL BITCOIN (BTC) IS EQUAL. SOME IS TOXIC AND UN-REDEEMABLE.

One of the side effects of having an “immutable public ledger” is that all bitcoin transactions are recorded and available for examination. This includes transactions involving criminal activity such as sanctions violations, dark market exchanges, fraud and cyber terrorism, ransom payments, etc. Criminals are widely using Bitcoin as the preferred method of making large cross-border payments. But, converting that crypto back into useful “money” is becoming an ever-difficult thing to accomplish. There are fewer and fewer places that aren’t using KYC and AML rules. More and more blockchain analytics companies are examining transactions and tracing movements of crypto through the market, and cross referencing this with known criminal activity, compiling ‘blacklists’ of wallets involved in criminal activity. If the crypto you have can be traced back to blacklisted wallets, your accounts can be seized. You may even find yourself being criminally liable. Exchanges will avoid doing business with flagged accounts for fear of getting in trouble themselves (plus it gives them an excuse to not cash you out and maintain more of the ever-diminishing liquidity they may have on hand). Your crypto could be OK today, but flagged tomorrow — there’s no way to know for sure unless you can trace the entire history of all your crypto from the moment it was minted and confirm legitimate acquisition. Most crypto holders cannot do this. As such, holding and trading crypto introduces another ticking time bomb that could invalidate any profits you think you’ve made. - THE VAST MAJORITY OF THE WORLD STILL DOESN’T CARE CARE ABOUT BITCOIN REGARDLESS OF THE “PRICE”

At the end of the day, all crypto proponents have is, “nUmBeR gO uP!” We’ve already explained that this number is the result of manipulation and stablecoin inflation, but more importantly, if every cryptocurrency on the planet disappeared tomorrow and was utterly worthless, not a single important (non-criminal) product or services anywhere in the world would be affected whatsoever. How can something that’s supposedly worth so much, that’s so “innovative” and “world-changing” not have any actual real-world utility? Why are people dismissed and told, “You don’t understand!” when they ask this basic question?