This is the master source for this document (at ioradio.org) – Last Updated 6/17/23

Submitted for your analysis: Crypto is a much worse “investment”. It’s more speculative. It’s more volatile than stocks, gold or even Beanie Babies, comic books or Pokemon cards.

People like to compare crypto to the stock market, but is it really like the market? (NO: Stocks represent actual fractional ownership in real companies that make products and create value that can be paid as dividends – crypto has no such function – and staking is not the same thing – you’re just paid in more crypto, not actual value)

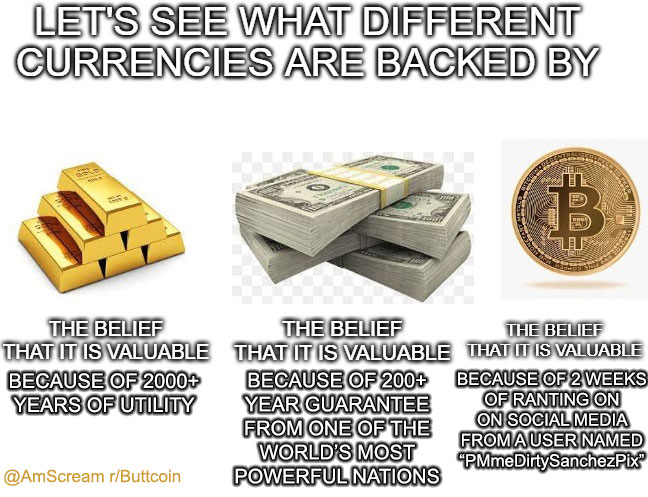

People claim the way to make money in crypto is not any different from other markets or speculative things like gold.

How accurate is this?

The reality is, it’s not true, and I’ll explain why.

Sure, crypto, like stocks, gold or Beanie Babies, is something you buy-and-sell. And if you do it right, you buy low and sell high, and you make money. The concept sounds very simple. So why isn’t crypto as good as other things like stocks, gold, or even Beanie Babies?

The answer is simple: intrinsic value.

What is intrinsic value?

Intrinsic value is the ability for something to have value to people in a tangible, material way. This is different from extrinsic value, which is value people attribute to something based on emotion or opinion. Extrinsic value is not material.

For something to have intrinsic value, its value is not predicated on what other people think. Extrinsic value is predicated on what other people think.

For example, honey. While you can buy and sell honey. You can also consume honey. Honey contains calories that are useful, has a long shelf life, and it tastes good and people need calories to live. This is intrinsic value. Whether people like honey; whether honey is popular, has no effect on its intrinsic value.

If honey becomes scarce or particularly popular as a condiment, it can have added extrinsic value by a society. In such a case, the price of honey will rise. Supply and demand will determine what is an average price for honey. But, since honey has intrinsic value, it will never be completely worthless. There will always be some people who will buy honey to consume/use it, and not as an investment. Also, the market for honey will always be around, and the longer it’s around, the more likely it can become more popular.

Gold works the same way. So do Beanie Babies.

Crypto does not.

Crypto has no material use. It has no intrinsic value. It is exclusively a token created to be sold. People only buy crypto for one thing: to trade for something else of value.

Like most currencies, crypto is just a unit that is used for exchange, not to read, not to eat, not to hang on your wall, not to wear, not to play with. In this way, a bitcoin is kind of like a dollar bill: its only use is to trade for something else. But unlike fiat, crypto isn’t guaranteed to be legal tender in most places. (So don’t go off-tangent arguing “fiat is the same thing” – it’s not, and that’s a separate argument for later)

So the value of crypto is based on something else other than intrinsic value… Let’s examine this dynamic.

So how do these differences affect crypto as an investment? Let’s unpack how the whole “make money” process works…

So we know: price is based on supply and demand. We know how supply works, but how does demand work?

Demand works in two different, separate ways:

- Intrinsic value – if something has material use, it will be in demand. If an item can be consumed, enjoyed, or otherwise used in a material way, people will acquire that item.

- Popularity – The other way demand is created is through marketing and peer pressure. If you can make something very popular, there will be lots of demand for it. Advertising is one of those driving forces. Everything from music to fruits and vegetables are often driven by popularity. If stations play a song enough times, it creates demand for the song/artist. If you’re part of a culture that eats certain types of food more than others, your culture advertises those products and within your culture, demand for them increases.

So what gives something value?

A combination of intrinsic value + popularity.

Products that have the most value for the longest period will end up having the highest intrinsic value. Products that have value for short periods of time, often are centered around advertising & marketing more than intrinsic value.

BUT almost all products at least have some combination of intrinsic and extrinsic value.

With stocks, the intrinsic value is the company’s material assets. No matter how unpopular a company is, if they own a lot of assets or are profitable, their stock has a “minimum value” it’s unlikely to ever sell under. If the price of a stock fell below its intrinsic value, that company could likely be acquired and liquidated for profit.

So what gives Beanie Babies intrinsic value? They’re cute stuffed animals. Many people buy Beanie Babies because they enjoy them, and the main ongoing interest for Beanie Babies was never as an investment. The same thing can be said for speculative markets like comic books, or Pokemon cards: most people buy them to read/play. They aren’t looking to hold them as investments, so the money that goes into that market stays in the market.

In sharp contrast, nobody buys crypto for any other reason than to sell it. So its demand is 100% based on extrinsic value, marketing, advertising and hype.

So crypto has only half of the formula for creating demand. It can’t rely on intrinsic value.

So even on the worst day for Pokemon, gold, Beanie Babies or comic books, they’re still likely to hold and maintain value more than crypto, because there are people out there who buy those things for their material value and don’t care about seeing a profit.

What this means is: Products with more intrinsic value are least likely to drop much in price, and more likely to maintain their value longer.

Products with less intrinsic value are more dependent upon marketing and advertising to maintain demand/value. This also explain why crypto is not any sort of “hedge against other markets.” Since it has no intrinsic value, it is even more tied to other markets and economies. If the economy is bad, you’re less likely to put your money into something that has no intrinsic value.

This isn’t to say there’s no examples of things with no material value being popular for long periods of time. Look at religion. It offers very little (evidence-based, testable) tangible benefit, but is very popular. This is because it’s become a cultural phenomenon as well as has a huge advertising and marketing system behind it. (It also didn’t hurt that most major religions were imposed by force upon the populace by oppressive central authorities)

This also explains why the crypto industry appears to be more cult-like. Crypto shares more attributes with religion than it does traditional investments. If you’re trying to sell somebody something, and you can’t demonstrate any measurable material value, then it’s has to be heavily hyped. This is how religion sells itself. This is also how crypto sells itself.

So why is crypto not that great of an investment?

In order to maintain demand, there has to be constant marketing. This is a significant burden to bear. Most cryptos have already failed.

Like religion, crypto also requires a “bubble” to operate in, that is insulated from criticism. Like religion, crypto makes grandiose claims that aren’t always logical. So the less skepticism adherents are subject to, the more likely their model can sustain itself. It’s not necessarily the best way to live unless you’re the one running the “church (or exchange).”

Can crypto deliver on its promises?

At the end of the day, the one question we want to know is: Will I become rich with crypto?

The answer, unfortunately, is “No.”

But wait.. you’ve heard of “some people” who have gotten rich, so that can’t be right?

Sorry, you are not those people. Those people came along long before any of these promises were made. Those people weren’t “retail investors.” They were the priests and pastors who started the church, not the ones attending service. The people you’re hearing about are the same people who pretend to have their cancer cured by the televangelist on TV. They’re not really “rich”, they just act like they are.

Why “Liquidity” Matters?

Here’s the dirty secret people aren’t supposed to know: The value in the crypto market isn’t really there. Even the most respected exchanges have been caught manipulating the market.

If you want to know whether you can make money in a market, the first thing you want to investigate is Where does the money go?

Money is “liquidity.” Liquidity is value.

Crypto is not liquidity. Crypto is a coupon that someone offers you that promises maybe you can convert it into value.

But in order to cash out your crypto, there has to be some pool of value. Where is this pool of value? Where is the liquidity?

When we answer this question, it becomes obvious, you’re not only not going to be rich, but you’re likely going to lose all your principal as well.

This isn’t speculation. This is basic math. This is why people call crypto as an investment a Ponzi scheme. The liquidity to pay people off is not there.

Remember that bowl you put the $100 in, and got 1 BTC out of? The person that sold you the BTC took the $100 out of the bowl. The bowl is empty at that point. That represents how much “liquidity” is in the crypto market: zero.

Liquidity is important because liquidity is what powers the market, what makes it appear to be materially viable and not just a charade.

Imagine we’re selling comic books instead of crypto. That bowl will probably never be empty. Because there will be people who buy comics for their intrinsic value, with no intent to sell, so the money they put into the market, stays in the market and creates incentive for the industry to make more comic books. The same goes with Beanie Babies.

But with crypto, the only reason you buy it, is to trade it. So there is no liquidity there. If too many people try to cash out, there isn’t a way to service them unless there’s a never ending stream of new buyers. The market doesn’t sustain its own production and operation.

The bowl is empty. The bowl (market) will only fill if you can recruit more people to put money/crypto in it.

This is why there really aren’t any non-exploitative players in the crypto market. There’s no reason to be there except to entice new buyers. But the product you’re selling has no intrinsic value, so you have to use peer pressure to exclusively create demand. It’s a very stressful, very costly way to maintain an industry. Like any structure, without a solid foundation that can survive a variety of different environments, it will likely collapse.

Welcome to crypto-currency.